A Guide to The Mortgage Guarantee Scheme (2021)

Buy a home with just 5% Deposit with the new Mortgage Guarantee Scheme.

The New Mortgage Guarantee Scheme was designed to help people with a 5%-9% Deposit to buy a new home with a 91% to 95% Loan to Value (LTV) Mortgage.

Due to the COVID pandemic, 95% LTV Mortgages were withdrawn by mortgage lenders, leaving a gap in the market.

This scheme reduces mortgage lenders risk with the Government implementing a guarantee to compensate for any losses.

A similar mortgage guarantee scheme was introduced as a response to the 2007 financial crash. It ran for four years and helped more than 100,000 people get onto the property ladder.

If you have a low deposit? This new scheme will bring back 95% LTV Mortgages. Helping you buy a home! Starting 1 April 2021

Will the Mortgage Guarantee help me?

If you are a first-time buyer or a home mover with a small deposit, the scheme is available to you. It is not available for remortgages, second homes or buy-to-let.

✅First Time Buyers ✅Homemover ✅5%-9% Deposit ✅Under £600,000 Value 🚫Buy-to-Let 🚫Remortgage 🚫Second Homes 🚫Over £600,000 Value

How will it work?

You will need a personal deposit of 5% of the value of your new home.

If you want to purchase a property for £200,000.

You will need 5% of the value of the property for the deposit of £10,000.

You do not need to worry about the Mortgage Guarantee. It is arranged by the mortgage lender and is there to protect them.

The Government has said they want to turn generation rent into generation buy. And one way they can do this is by giving Mortgage Lenders confidence to return to 95% Mortgages.

Am I eligible for 95% LTV Mortgage Guarantee Scheme?

The Government has set the following eligibility criteria:

- be a residential mortgage (not second homes or buy-to-let)

- be taken out by an individual or individuals rather than an incorporated company

- be on a property in the UK with a purchase value of £600,000 or less

- have a loan-to-value of between 91% and 95%

- be originated between the dates specified by the scheme

- be a repayment mortgage and not interest-only and

- meet standard requirements in terms of the assessment of the borrower's ability to pay the mortgage, for example, a loan-to-income and credit score test

In addition to the above, each mortgage lender will have their own criteria. Talk to a mortgage adviser to check your eligibility.

How much will I be able to borrow?

We expect mortgage information to be published on 1 April 2021.

The scheme does not require mortgage lenders to make changes to affordability. Your income may limit how much you can borrow.

Affordability

How much can you borrow?

Why was the Mortgage Guarantee Scheme Brought in?

The availability of high loan-to-value (LTV) lending has seen a sharp reduction throughout the COVID-19 pandemic. This reduction in high LTV mortgage availability has reduced people's ability with smaller deposits to access mortgage products.

In this scheme, people with a 5% deposit, such as first-time buyers, get on the property ladder and home movers move onto the next property.

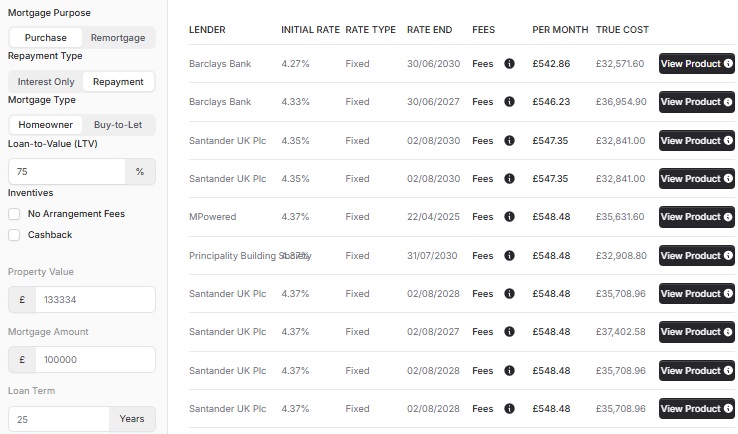

Mortgage Lenders offering 95% LTV Mortgages include:

The mortgage guarantee scheme banks announced so far are Lloyds, Natwest, Santander, Barclays and HSBC, with Virgin Money set to pledge their support to the scheme soon.

When does the Mortgage Guarantee Scheme End?

The scheme is was scheduled to end on 31 December 2022 but after Government review was extended.

It's likely not to be removed if the Government feels mortgage lenders will not continue offering 95% LTV Mortgages without it.

Are there alternatives to the new 95% Mortgage Guarantee Scheme?

There are many other options, including:

- Help-to-Buy on New Builds.

- 95% LTV Mortgages (without the scheme)

- 75% LTV Mortgages with 20% LTV 2nd Charge

- Shared Ownership Mortgages

- Guarantor Mortgages

You can discover the options available with a discussion with your mortgage adviser.

How to apply for a mortgage through the new Guarantee Scheme?

You need to talk to our Mortgage Advisers on 01133 205 902. To check your eligibility for the scheme and recommend the mortgage lender and scheme if applicable.

You do not need to register for the scheme independently.

The Government provides insurance for banks to encourage high loan-to-value (LTV) lending. You do not need to register for the scheme independently. The mortgage lender will do it.

The mortgage guarantee scheme is available until 31 December 2022.

The scheme is not designed for people with bad credit. If your bed credit is historical, talk to our mortgage advisers to determine availability.

The mortgage guarantee scheme rules include:

- be a residential mortgage (not second homes or buy-to-let)

- be taken out by individuals (not companies)

- be on a property in the UK

- be a property with a purchase value of £600,000 or less

- have a loan-to-value of between 91% and 95%

- be a repayment mortgage and not interest-only and

- meet standard lender assessments (affordability, credit score, etc..)

Yes, the scheme is available to First Time Buyers.

Yes, the scheme is available to people selling their current residence and buying a new one.

No. The scheme is only available to First Time Buyers and Home Movers, not remortgages.

Yes, the mortgage guarantee scheme is available for New Build Properties. The existing Help-to-Buy Scheme is also available. Talk to your mortgage adviser for a recommendation.

Yes, the mortgage guarantee scheme is available for non-new build properties. You can use it on "used homes".

No, the mortgage guarantee scheme is only available on a Repayment Basis Only.

No, the mortgage guarantee scheme is only available on properties you will reside. Landlords can use it for an onward purchase for your residence.

Due to be announced on 1 April 2021.

Due to be announced on 1 April 2021. Some mortgages are portable talk to your mortgage adviser about porting or remortgaging.

The scheme is insurance for mortgage lenders to protect them from losses from borrowers defaulting. This highlights why it may be a bad idea for you. With small deposit mortgages, you pay a higher interest rate and are at higher risk of negative equity (owing more than your house is worth) if property prices fall.

To help inform the article we used varied sources of information.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX