Holiday Let Mortgage (AirBnB, etc)

Get a Mortgage to start your Holiday Let Business

Its challenging finding lenders for Holiday Let Mortgages. Our expert advice can open doors for you.

A holiday let mortgage is a type of loan that is specifically designed for individuals who want to purchase a property that they plan to rent out to tourists on a short-term basis as a business venture.

This type of mortgage is different from a holiday home mortgage, which is a loan that is taken out to finance the purchase of a second home that will only be used by the borrower.

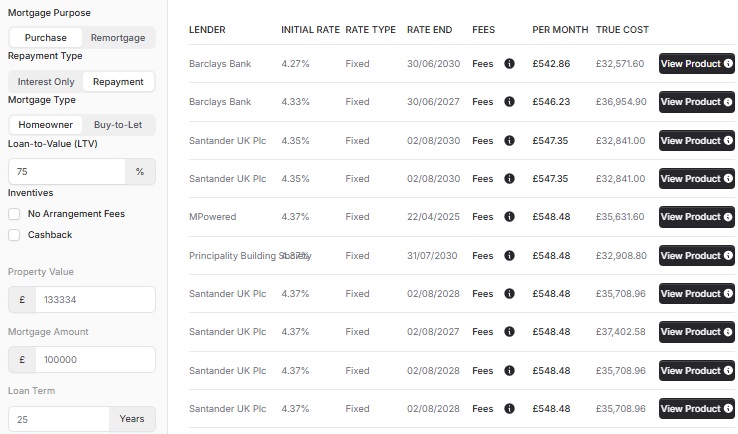

Lowest Holiday Let Mortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

2.75%

2 Years Fixed

2

Years

Fixed

at

2.75%

|

|

|

|

2.75%

2 Years Fixed

2

Years

Fixed

at

2.75%

|

|

|

|

2.85%

2 Years Fixed

2

Years

Fixed

at

2.85%

|

|

|

|

2.85%

2 Years Fixed

2

Years

Fixed

at

2.85%

|

|

|

|

3.29%

2 Years Fixed

2

Years

Fixed

at

3.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

2.75%

2 Years Fixed

2

Years

Fixed

at

2.75%

|

|

|

|

2.75%

2 Years Fixed

2

Years

Fixed

at

2.75%

|

|

|

|

2.85%

2 Years Fixed

2

Years

Fixed

at

2.85%

|

|

|

|

2.85%

2 Years Fixed

2

Years

Fixed

at

2.85%

|

|

|

|

3.75%

2 Years Fixed

2

Years

Fixed

at

3.75%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

2.85%

2 Years Fixed

2

Years

Fixed

at

2.85%

|

|

|

|

2.85%

2 Years Fixed

2

Years

Fixed

at

2.85%

|

|

|

|

3.85%

2 Years Fixed

2

Years

Fixed

at

3.85%

|

|

|

|

3.85%

2 Years Fixed

2

Years

Fixed

at

3.85%

|

|

|

|

4.64%

5 Years Fixed

5

Years

Fixed

at

4.64%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

🏖️How much deposit do I need for a Holiday Let mortgage?

Talk to us about your savings, lets see where you are or where you need to be

The deposit for a Holiday Let mortgage starts at 15% of the property value. Aim for a 25% deposit and 75% LTV Holiday Let Mortgage to maximise rental yield. If required, we can help you raise the deposit by remortgageing your home or your remortgage your buy-to-let Properties.

🏖️How are Holiday Let Mortgage affordability assessed?

Let's use our affordability calculator to determine your target property value range.

At a basic level, mortgage lenders calculate the maximum loan amount based on the standard buy-to-let rental income, as if the property was rented to a family.

Recently, some lenders, have changed their approach. They now assess affordability using an average of low, medium, and high-season expected rental income.

Your own financial situation matters. Lenders consider your income, expenses, and existing debt. They also assess your credit history and conduct stress tests to ensure you can handle potential interest rate increases.

🏖️Who offers holiday let mortgages?

Our goal is to work with every lender available, and we welcome the challenge of finding you the best option.

There are fewer mortgage lenders offering holiday let mortgages than standard buy-to-let mortgages. Some lenders specialize in this niche market. Exploring your options and working with a mortgage adviser who can guide you to suitable lenders is essential.

🏖️Are holiday let mortgages more expensive?

Holiday-let mortgages often have higher interest rates and fees than standard buy-to-let mortgages. However, the potential rental income from holiday lets can offset these costs, making them a viable investment option.

🏖️Talk to our Holiday Let Mortgage Advisers

-

Buy-to-Let Mortgage

>

Dive into property investment with our Buy-to-Let Mortgage, tailored for both seasoned investors and first-timers seeking to build a profitable portfolio.

-

Buy-to-Let Remortgage

>

Maximize your investment with Buy-to-Let Remortgage, ensuring optimal returns by refinancing your property portfolio with competitive rates.

-

Buy-to-Let Rate Switch

>

Enhance your property investment strategy with a Buy-to-Let Rate Switch, ensuring you stay competitive in the market with a smart financial move.

-

Buy-to-Let Company Mortgage

>

Optimize your property portfolio's potential with a Buy-to-Let Mortgage in your SPV Company Name, combining strategic investments with simplified financial structures.

-

Portfolio Mortgages

>

Grow and diversify your property portfolio with our Portfolio BTL Mortgages, offering tailored solutions for seasoned investors aiming for prosperity.

-

Holiday Let Mortgage

>

Transform your vacation home investment dreams into reality with a Holiday Let Mortgage,

-

HMO Mortgage

>

Unlock the potential of shared living spaces with our HMO Mortgage, tailored to support your investment in Houses in Multiple Occupation.

-

HMO Company Mortgage

>

Elevate your HMO investment strategy with our HMO Mortgage in your SPV Company Name, combining strategic planning with streamlined financial structures.

-

HMO Remortgage

>

Revitalize and optimize your HMO investment with a strategic HMO Remortgage, ensuring your shared living spaces remain lucrative in the market.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX