Minimum Deposit for Buy-to-Let

Mortgages are available up to 85% Loan to Value (LTV) for Purchase or Remortgage. 85% LTV Buy-to-Let mortgages are the highest LTV you can get as a property investor. That's just a deposit of 15% of the property value.

Landlords with larger deposits can enjoy rates up to 2% lower, including lower fees, at 80% LTV compared to 85% LTV.

85% Let Mortgages in 2019 are popular in BTL Mortgage Comparison research, allowing landlords to use 'leveraging'. The High LTV Buy to Let Mortgage used to purchase more properties compared to a few with a Lower LTV.

The monthly rental amount can limit the maximum loan achievable and, therefore, require higher deposits. Our mortgage advisors can help you release equity from other properties to raise a deposit.

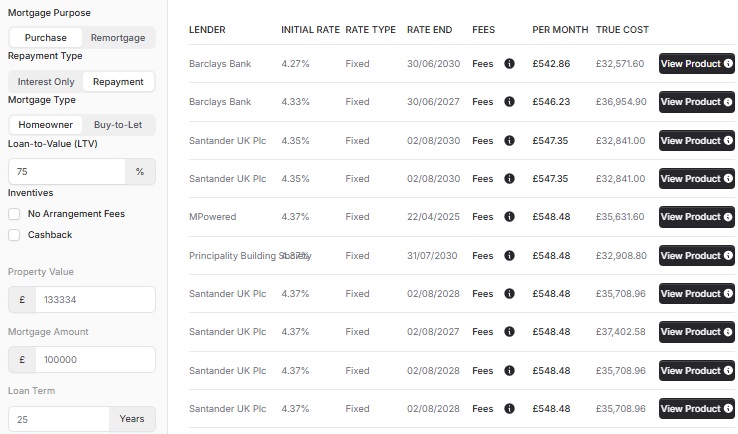

Lowest 85% LTV BTL Mortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.49%

5 Years Fixed

5

Years

Fixed

at

6.49%

|

|

The mortgage products shown are for illustrative purposes only and were generated 17 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.49%

5 Years Fixed

5

Years

Fixed

at

6.49%

|

|

The mortgage products shown are for illustrative purposes only and were generated 17 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.49%

5 Years Fixed

5

Years

Fixed

at

6.49%

|

|

The mortgage products shown are for illustrative purposes only and were generated 17 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.49%

5 Years Fixed

5

Years

Fixed

at

6.49%

|

|

The mortgage products shown are for illustrative purposes only and were generated 17 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 26 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 17 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 17 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 17 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

What is an 85% LTV Mortgage?

Loan to Value (LTV) is the mortgage amount percentage of the total value or purchase price. You can borrow up to 85% of the value of a Property.

As an example on a property worth £100,000. With an 85% LTV Mortgage you can borrow up to £85,000. That means just a deposit or equity of £15,000.

Mortgage Lenders consider 85% LTV as high risk giving us few options. The higher risk and fewer options are reflected in the mortgage rates and fees charged.

Whilst 85% LTV Mortgages are available. The maximum loan is still constrained by affordability, mainly the rent achievable.

What are the benefits of 85% LTV Mortgages?

Mortgages at 85 LTV are the highest property investors can obtain.

On purchases, you can buy a property with very little deposit.

On remortgages, you can raise capital from your property. Enabling you to use funds elsewhere such as a renovation or expanding your portfolio.

Can you borrow up to 85% LTV of the Property Value?

The affordability of a Buy-to-Let Mortgage is based on the rent that is achievable. It can be difficult for landlords to reach a rental stress test of 85% LTV.

Completing the mortgage on a Five Year Fix and/or Limited Company may open up more options. Our mortgage advisers will be able to guide you in this.

For illustrative purposes only. On a mortgage of £170,000 with the Kensington Product, you would require £974 rent and £1090 from KRBS.

85% LTV Mortgage Criteria

- Available for Houses in Multiple Occupation (HMOs)

- Available for Multi-Unit Blocks.

- Available for Limited Company Buy to Let.

- Available for Trading Companies.

- Available in England, Wales, Scotland and Northern Ireland.

- No Minimum Income.

- Interest Only or Repayment.

- Minimum 1 Year Landlord Experience Required

Can you get 85% LTV Mortgage in a limited company?

The products available are for Personal Name or in a Limited Company Buy-to-Let if purchasing in a Special Purpose Vehicle (SPV).

-

Buy-to-Let Criteria

>

Navigate the world of property investment confidently with our Buy-to-Let Criteria, ensuring you meet the standards for unlocking lucrative opportunities.

-

Buy-to-Let Affordability

>

Achieve investment success with Buy-to-Let Criteria Affordability, ensuring your property ventures align seamlessly with your financial capabilities.

-

Buy-to-Let Minimum Deposit

>

Your Guide to the Minimum Deposit required to get into Buy-to-Let.

-

Buy-to-Let for First Time Buyers

>

Embark on your property investment journey confidently with Buy-to-Let for First Time Buyers, tailored to guide newcomers towards their first lucrative investment.

-

Buy-to-Let Personal Guarantee

>

Your Guide to Personal Guarantees and Buy-to-Let.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX