HMO Mortgages

The best place to find landlord HMO Finance simpler, clearer, faster

Experts in HMO Mortgages from Licenced to Unlicenced, with First Time Landlords or Portfolio Landlords. We're here to help.

Lowest House in Multiple Occupation (HMO) Mortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

2.30%

2 Years Fixed

2

Years

Fixed

at

2.30%

|

|

|

|

2.40%

2 Years Fixed

2

Years

Fixed

at

2.40%

|

|

|

|

2.50%

2 Years Fixed

2

Years

Fixed

at

2.50%

|

|

|

|

2.55%

2 Years Fixed

2

Years

Fixed

at

2.55%

|

|

|

|

2.65%

2 Years Fixed

2

Years

Fixed

at

2.65%

|

|

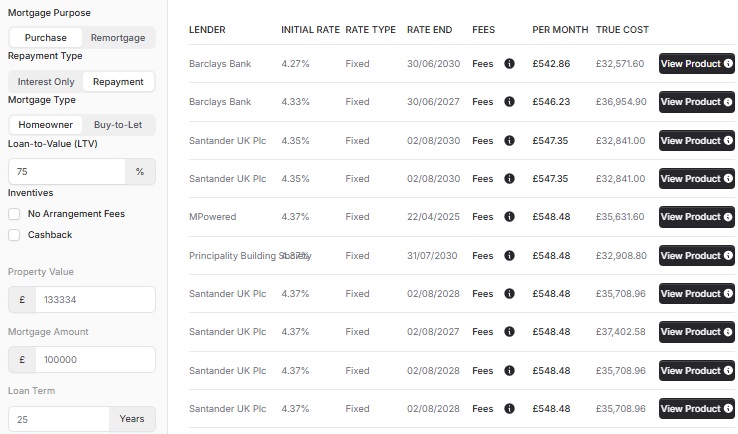

The mortgage products shown are for illustrative purposes only and were generated 22 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

2.30%

2 Years Fixed

2

Years

Fixed

at

2.30%

|

|

|

|

2.40%

2 Years Fixed

2

Years

Fixed

at

2.40%

|

|

|

|

2.50%

2 Years Fixed

2

Years

Fixed

at

2.50%

|

|

|

|

2.55%

2 Years Fixed

2

Years

Fixed

at

2.55%

|

|

|

|

2.65%

2 Years Fixed

2

Years

Fixed

at

2.65%

|

|

The mortgage products shown are for illustrative purposes only and were generated 22 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

3.54%

2 Years Fixed

2

Years

Fixed

at

3.54%

|

|

|

|

3.77%

2 Years Fixed

2

Years

Fixed

at

3.77%

|

|

|

|

4.05%

2 Years Fixed

2

Years

Fixed

at

4.05%

|

|

|

|

4.11%

2 Years Fixed

2

Years

Fixed

at

4.11%

|

|

|

|

4.21%

2 Years Fixed

2

Years

Fixed

at

4.21%

|

|

The mortgage products shown are for illustrative purposes only and were generated 22 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 22 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

🔷What is an HMO mortgage?

If you intend to buy (or remortgage) a property to rent it out to more than one household, you require a House of Multiple Occupancy (HMO) Mortgage. Your standard Buy to Let Mortgage contract often limits the number of households that can live in a property and limits tenants to having just one tenancy. An HMO mortgage is a different contract with a mortgage lender. These contracts allow you to have multiple households and each of them to have their individual tenancy (if required). If your property does not require an HMO License, you can benefit from traditional Buy-to-Let Rates in certain circumstances. Available from a select few mortgage lenders. If you require an HMO License or in a Selective Licensing Area you will need an HMO mortgage.

🔷Are HMO's a good investment?

In comparison to renting a property to a single-family. The rental income from multiple occupants often results in higher aggregate rental income. This may not always be the case. It may be that shared housing is in low demand in an area compared to single-family lets. A local letting agent will help you compare how much rent you will get in each configuration to help you decide. Unfortunately in HMO's tenant turnover may be higher. With tenants staying in HMO's for shorter periods. This can result in higher management costs and increased frequency of decoration. Fortunately, a tenant moving out of an HMO will only result in a small decrease in rental income that month. Compared to a whole family moving out of a property, giving you no income that month. (or until it's rented). An HMO is more of an investment than a single let. You may need to apply for licences after renovation. Perhaps installing commercial fire systems, locks on doors and reconfiguring a properties layout. HMO's can be good investments but the answer is subjective. Results may vary.

🔷What is an HMO Property?

An HMO is a rental House that has Multiple Occupants from multiple families, sharing facilities and typically renting. The full name is a House in Multiple Occupation ( HMO ). That's as complicated as it needs to get but some may get confused as you learn more. A property can be a House in Multiple Occupation (HMO) with or without the need of an HMO Licence. Your local council will class all multi-occupancy properties as either an HMO that requires a licence or an HMO that doesn't require a licence. In addition to an HMO that requires planning or an HMO that doesn't require planning. Mortgage Lenders will class the property as an HMO depending on the number of occupants as above, as well as the number of tenancies a property has.

🔷What does HMO stand for?

HMO is short for House in Multiple Occupation. It's used to describe a house that has many unrelated tenants. Typically three or more tenants share a kitchen, bathroom or both. A property can be a Licensable HMO or an Unlicenced HMO. An Unlicensed House in Multiple Occupation is small up to two tenants sharing. A Licensable HMO is three or more unrelated tenants. Property is not an HMO if the household consists of members of the same family. Including half-relatives, foster children or domestic staff. What does HMO Mortgages Mean? If a property intends to be used as an HMO, the owner will require an HMO mortgage. Normal Buy-to-Let mortgages typically don't allow multiple occupants.

🔷How are HMO Properties Valued?

Your HMO Property is valued in one of two ways — either Brick & Morter or on an Investment Basis (aka Commercial Valuation).

Brick & Mortar valuation is your standard residential property valuation. It is based on the resale value of the property as a typical home. Comparable with other none-HMO properties on the street.

An Investment Valuation instead calculates the value as a business. The surveyor will base the amount on a multiple of the Rental Income of the property as an HMO. It is based on the resale value to another HMO Investor.

In different circumstances, one may be better than the other. An Investment Valuation may give a higher value. Except mortgage products are fewer, giving higher rates and lower LTVs.

The decision of which valuation type, is not yours. It is up to the mortgage lender. Some offer an investment basis and others don't. Some have conditions such as the property being a certain number of rooms, as well as having a licence.

HMO Investors should note that the Purchase Price and Value are not the same things. If you agree a higher Purchase Price than what it is valued on a Residential home, you often negotiate it down. On HMO's it's not unexpected to pay money on top of the mortgage & deposit.

🔷Do I require an HMO License before applying for a mortgage?

HMO Mortgage Lenders often require you to have applied for an HMO mortgage license from your Local Authority (if required) at application. This criteria changes from lender to lender, so check with your Mortgage Adviser.

🔷How long does an HMO Mortgage take?

It takes the same amount of time processing an HMO Mortgage as any other. Up to 2 months to complete on purchase-including time for Survey and Legals. An additional step for HMO mortgage lenders is checking you have an HMO Licence, Planning (if required) and Selective Licensing (if required). Also, due to the commercial valuation on larger HMO's the valuation may be slower. These checks should not push the time too much. As always a prepared borrower and broker with the paperwork ready to go from the outset can cut these times. It will be a mortgage condition that you are deemed "fit and proper" to run an HMO. This allows lenders to grant finance on the sight of an application for the HMO licence. You can complete quicker if using Bridging Finance or Remortgaging. Some lenders are faster than others but it often depends on the complexity of the application.

🔷What Lenders offer HMO Mortgages?

Only a selection of Mortgage Lenders offer Mortgages for HMO Properties. Most do not offer HMO Mortgages direct to consumers. Available only via mortgage advisers. With it being Commercial Lending you won't find them available in an HSBC Branch. Besides this, not all mortgage brokers are the same. HMO Mortgages are in a subset of the specialist area of Buy-to-Let Mortgage Advice. To get the best HMO Mortgage you need to talk to a Mortgage Adviser specialising in HMO Finance. We have several lenders.. We have a wide variety of House in Multiple Occupation (HMO) mortgage lenders with differing products and criteria. Some are available via mortgage advisers only and others exclusive products. Some of the lenders we use are:

- Aldermore Mortgages

- Axis Bank

- BM Solutions

- Barclays Bank

- Fleet Mortgages

- Foundation Home Loans

- Interbay

- Kent Reliance

- Keystone

- Landbay

- Leeds Building Society

- LendInvest

- Magellan Homeloans

- Masthaven

- Paragon Banking Group PLC

- Precise Mortgages

- The Mortgage Lender

- The Mortgage Works

- and Vida Homeloans

🔷HMO Criteria & Regulations

Mortgage Lenders for HMO's have criteria on both you and your property. Will you qualify for an HMO Mortgage? Typical mortgage criteria apply to you such as Credit Rating. Many HMO banks prefer you to have experience as a landlord before your first HMO Property. Others go further requiring experience as an HMO Landlord. There are a few lenders that accept borrowers without landlord experience. As well as checking yourself and if you have experience or if its an HMO mortgage first-time Landlord. Lenders have different HMO mortgage criteria on other attributes. Some for example only like small HMO's or if they are in student areas. To check HMO mortgage criteria, you can expect questions on:

- Expected Rental Income.

- The Types of Tenants.

- Number of Bedrooms.

- Number of Kitchens.

- If Kitchens or W/C is in the Bedsit.

- If there is a Living Room.

- If there is multiple Tenancy Agreements or one.

- If the property needs conversion.

- Licenced or Unlicenced Property.

- Landlord Experience (First HMO? First Rental?)

- Affordability Tests

Most HMO Buy-to-Let lenders can only be accessed via mortgage brokers. We will work through the lender's criteria to remove those in which you don't meet the criteria and find the best HMO Mortgage.

🔷HMO Types

There are many HMO Types that can determine which mortgage lender or HMO Product you can obtain. Some of the types include:

- Licenced or Unlicensed HMO's

- Selective Licenced HMO's or Normal

- Tenancy Type (Multi-Tenancies or One)

- Tenant Types

- - Professional Tenant HMO's

- - DSS Tenant HMO's

- - Student HMO's

- HMO Size

- - 6 Bed or Under

- - 6 Bed or Over

- HMO Design

- - Shared Living Room

- - HMO's with their own Kitchens.

- - HMO's with their own Bathrooms

- Multi-Unit Block

Some lenders prefer others, for example, options reduce on HMO Size. Most lenders do not like HMO's where Kitchens adjoin the bedsit.

🔷What are HMO minimum room sizes?

New Regulations in 2018 set out national minimum room sizes for Houses in Multiple Occupation (HMO). The room sizes originally were set by your local authority. The new requirement for HMO Licences issued after 1 October is that:

- Bedrooms used by one adult must be no smaller than 6.51 square meters (70 square feet).

- Bedrooms used by two adults must be no smaller than 10.22 square meters (111 square feet).

- Bedrooms used by one child aged 10 years and younger must be no smaller than 4.64 square meters (50 square feet).

No sleeping accommodation in your HMO can be smaller than 4.64 square meters (50 square feet). Existing HMO Licences do not have to meet the condition. Although they will on the Licence Renewal. Areas with Mandatory, Additional or Selective Licensing may find larger room sizes are set by the local authority. HMO Mortgage Lenders will be checking to ensure they do not offer finance to those in breach. You may require bridging finance to rectify sizes prior to buying or remortgaging.

🔷What is an HMO Licence?

An HMO Licence allows you to rent your property to multiple occupants. Certification from your Local Council that you are a fit and proper person, and that the property fit. Landlords can be prosecuted by their local authority for not obtaining an HMO Licence. Though not all properties need an HMO Licence You should always check with your council if you need an HMO Licence. It should not be avoided with fines up to 12 months of rent. See also the Governments on HMO Licencing.

🔷Can I get an HMO Licence in a Limited Company?

Your HMO Licence will require a "responsible person" this can be you or your letting agent. The licence is for the property and to ensure the responsible person is fit and proper. So a company can have a Licenced HMO Property, though it won't hold the licence itself. You will.

🔷What rental income is needed?

HMO Mortgages often have higher rental stress tests than standard buy to let properties. On the other hand, you should obtain higher rent compared to a standard buy-to-let. New regulations limit borrowing based on the rent deemed achievable by the lender's valuer. The minimum is assessed at a rate of 5.5% ensuring a 125% coverage. For example, As such for a £100,000 mortgage you would need at least £572 rent, at a minimum. This demonstrates the minimum - mortgage lending criteria may be more robust. Landlords who are higher rate taxpayers or have personal income below a threshold. Have higher stress tests. Landlords who are higher rate taxpayers, often get five-year fix mortgages or invest via a limited company to obtain lower stress tests. Property types also affect affordability with HMO Mortgages having higher stress tests compared to standard lets. Our mortgage advisors will assess the market to help find the best mortgage given the anticipated rental amount. We can recommend structures to get lower stress tests or help release equity to fund higher deposits.

🔷Are HMO Mortgages regulated?

HMO Mortgages are not regulated by the Financial Conduct Authority (FCA). These are classed as commercial mortgages.

🔷Talk to our Buy-to-Let Mortgage Advisers

-

Buy-to-Let Mortgage

>

Dive into property investment with our Buy-to-Let Mortgage, tailored for both seasoned investors and first-timers seeking to build a profitable portfolio.

-

Buy-to-Let Remortgage

>

Maximize your investment with Buy-to-Let Remortgage, ensuring optimal returns by refinancing your property portfolio with competitive rates.

-

Buy-to-Let Rate Switch

>

Enhance your property investment strategy with a Buy-to-Let Rate Switch, ensuring you stay competitive in the market with a smart financial move.

-

Buy-to-Let Company Mortgage

>

Optimize your property portfolio's potential with a Buy-to-Let Mortgage in your SPV Company Name, combining strategic investments with simplified financial structures.

-

Portfolio Mortgages

>

Grow and diversify your property portfolio with our Portfolio BTL Mortgages, offering tailored solutions for seasoned investors aiming for prosperity.

-

Holiday Let Mortgage

>

Transform your vacation home investment dreams into reality with a Holiday Let Mortgage,

-

HMO Mortgage

>

Unlock the potential of shared living spaces with our HMO Mortgage, tailored to support your investment in Houses in Multiple Occupation.

-

HMO Company Mortgage

>

Elevate your HMO investment strategy with our HMO Mortgage in your SPV Company Name, combining strategic planning with streamlined financial structures.

-

HMO Remortgage

>

Revitalize and optimize your HMO investment with a strategic HMO Remortgage, ensuring your shared living spaces remain lucrative in the market.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX