You may be eligible to switch your current mortgage product for another one with the same mortgage lender. You may do so if you are coming to or have come to an end of the initial mortgage rate.

"Rate Switch" is another name for product transfers. They should not be confused with a further advance that allows additional borrowing. A product switch is like refinance.

What about rate switch, simpler?

Yes - some mortgage lenders (your existing lender) offer a rate transfer or product switch. Allowing you to obtain a new mortgage rate and move away from the mortgage lenders SVR.

Lenders treat product switches differently - for many, they do not revalue the property complete new stress tests or recheck you via their current criteria.

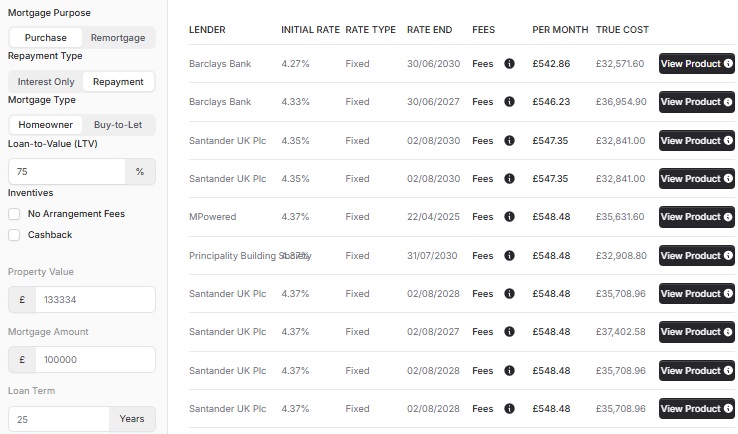

Unfortunately, product switch products may not be as competitive as other lenders, or the lender's remortgage products themselves.

Landlords can increase rental yield simply by keeping a close eye on when the initial mortgage product comes to an end.

When the date is near a Rate Switch enables you to avoid moving to the mortgage lenders Standard Variable Rate (SVR). It's a simple low-cost process and can be quicker/cheaper than a remortgage.

How do I apply for a buy to let rate switch?

It is essential you use a mortgage adviser who will compare a remortgage to a product switch. Doing so can ensure you get the best product to suit your needs and requirements.

Can I change the repayment method?

It is not typical to change the repayment method on product switch - though with some lenders it is possible to do. It's easier to move from interest-only to repayment than it is from repayment to interest only.

Can I extend the mortgage term?

It is not typical to change the repayment method on product switch - though with some lenders it is possible to do. It may bring in further eligibility criteria based on your age.

Can I increase my mortgage loan?

You can not increase your mortgage loan with a product switch, though you can use a Further Advance (or remortgage) a similar service some mortgage lenders offer via your mortgage adviser.

Are fees charged for product switches?

An arrangement fee may be charged depending on the product you select and your lender. Similar to remortgaging may be able to opt to pay a higher fee to obtain a lower interest rate.

Typically product switch fees are low. However, you may consider taking legal advice which may incur expenses.

How is my property valued?

Mortgage lenders use an Automated Valuation Model (AVM) to estimate the current value of the property.

Allowing better rates on house price rises allows lower Loan to Value, the opposite if the house price has fallen.

The accuracy is not always correct, especially if you have made changes to the property that may increase its value. It is often possible to ask for a valuation or look at remortgage options.

When can I use a rate switch?

Your mortgage adviser can apply to the lender to switch the mortgage product up to six weeks before the current product end date. Often just before your product would fall onto the lender's standard variable rate (SVR).

We can apply if you are late and are already on the mortgage lenders standard variable rate (SVR).

Are rate switches available for me?

Mortgage lenders criteria are not as comprehensive for product transfers as purchases or remortgages. Although Landlords still are checked against slimmed-down processes.

Eligibility Criteria may include your mortgage payment arrears history with the lender, credit history, loan to value and remaining term of the mortgage.

Who offers Buy to Let Rate Switch?

Unfortunately, not all buy to let mortgage lenders offer product switches. Though it is of the higher frequency with a large volume of lenders providing this service, to retain you as a client.

Those lenders that do not offer a product switch service may find you leaving them when your mortgage adviser considers remortgage options.

Why would I use a Rate Switch?

To some landlords a buy to let product switch is favourable as it is quick. Often you will not need a re-valuation or provide further evidence documents in most cases - though there are eligibility criteria.

-

Buy-to-Let Mortgage

>

Dive into property investment with our Buy-to-Let Mortgage, tailored for both seasoned investors and first-timers seeking to build a profitable portfolio.

-

Buy-to-Let Remortgage

>

Maximize your investment with Buy-to-Let Remortgage, ensuring optimal returns by refinancing your property portfolio with competitive rates.

-

Buy-to-Let Rate Switch

>

Enhance your property investment strategy with a Buy-to-Let Rate Switch, ensuring you stay competitive in the market with a smart financial move.

-

Buy-to-Let Company Mortgage

>

Optimize your property portfolio's potential with a Buy-to-Let Mortgage in your SPV Company Name, combining strategic investments with simplified financial structures.

-

Portfolio Mortgages

>

Grow and diversify your property portfolio with our Portfolio BTL Mortgages, offering tailored solutions for seasoned investors aiming for prosperity.

-

Holiday Let Mortgage

>

Transform your vacation home investment dreams into reality with a Holiday Let Mortgage,

-

HMO Mortgage

>

Unlock the potential of shared living spaces with our HMO Mortgage, tailored to support your investment in Houses in Multiple Occupation.

-

HMO Company Mortgage

>

Elevate your HMO investment strategy with our HMO Mortgage in your SPV Company Name, combining strategic planning with streamlined financial structures.

-

HMO Remortgage

>

Revitalize and optimize your HMO investment with a strategic HMO Remortgage, ensuring your shared living spaces remain lucrative in the market.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX